Uncertainty was the overarching theme in adtech news throughout 2024 - a year dominated by anticipated changes to third party cookies that didn’t materialize and the slowest period for adtech funding in over a decade.

That said, it wasn’t all doom and gloom. The latter half of the year brought a glimmer of hope with renewed M&A activity. High-profile deals, including mergers and acquisitions by Outbrain, Teads and Seedtag, signaled a renewed appetite for consolidation and innovation. And alongside the industry’s continued appetite for AI, growth in connected TV (CTV) and a general feeling of wanting to ‘just get on with it’, 2025 is likely to bring significant transformation in the space.

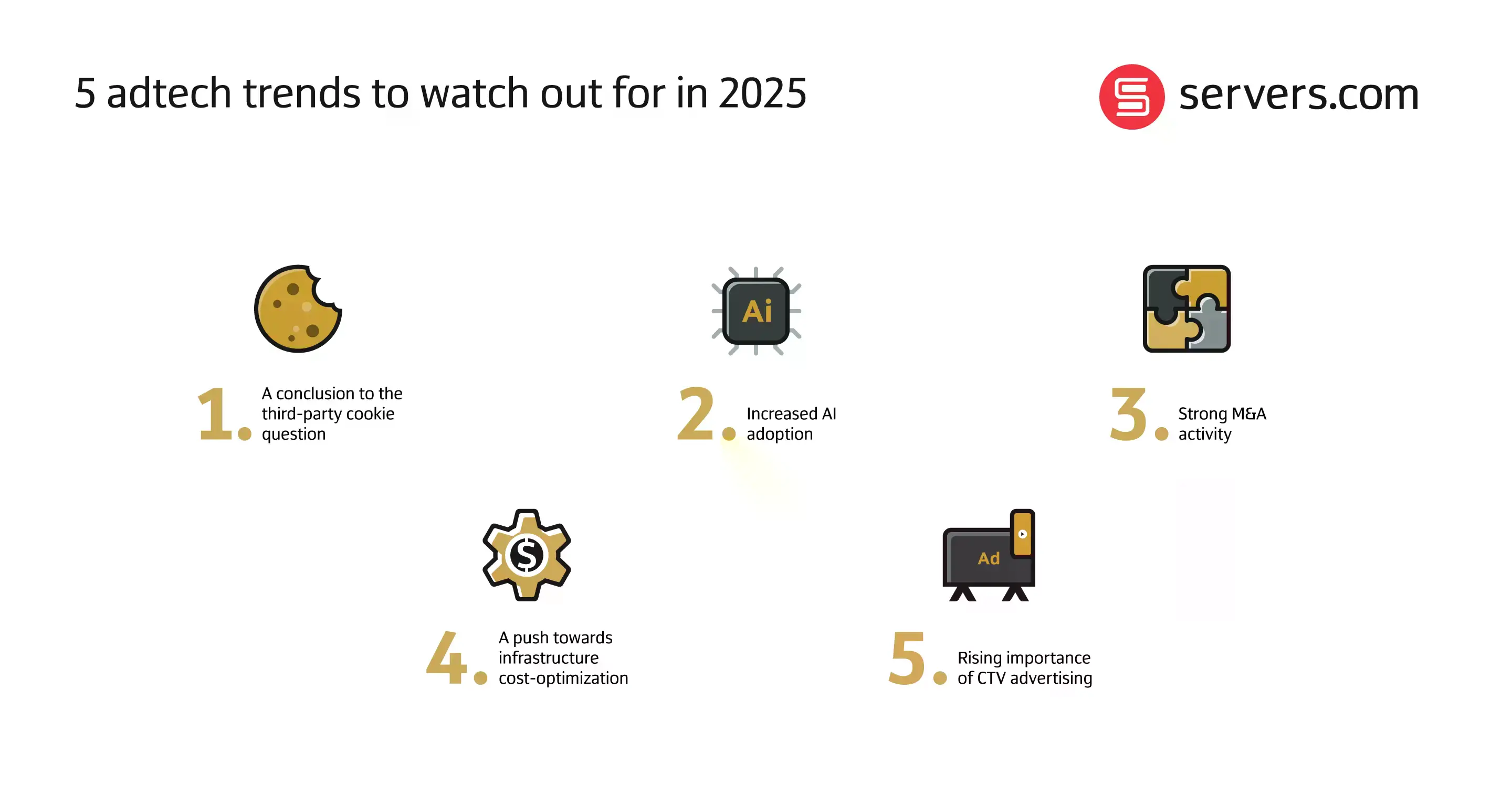

In this blog post I’ll be diving into the five key adtech trends that I think will further define the industry in 2025.

Firefox and Safari have already put an end to third-party cookie usage, but Google has been stalling behind. After three failed promises to halt their use, the organization has finally made a u-turn on its original plans. Naturally it’s left adtechs in limbo, querying whether the move towards first-party data collection and other privacy-led activities should still take precedence.

Given that the Competition Markets Authority (CMA) has influenced Google’s decision to halt third-party cookie depreciation, noting their plans might stand in the way of fair competition, there are mixed feelings across the industry. Much of this confusion stems from the fact that Google isn’t closing its Privacy Sandbox, but is instead leaving third-party cookies in place alongside other privacy-preserving options. From Google’s perspective, it’s a setup that offers users the freedom of an ‘informed choice’.

Much remains unsettled here, and many adtechs are still wondering what will come next. But for some, it’s left an aftertaste of concern over significant investments already made into privacy-first cookie alternatives.

Like in many other sectors, AI is continuing to redefine the adtech space and influence innovative new changes. Both supply-side platforms (SSPs) and demand-side platforms (DSPs) are leveraging AI and machine learning (ML) for ad campaign optimization, efficiency, traffic shaping and placement enhancement, with 87% of adtechs already attributing improved campaign performance to AI.

As AI and ML in advertising continues to advance, there are greater opportunities for adtechs too - many of which are already being realized. Current use cases include automating processes, customizing audience insights and building creative assets with generative AI. But as we enter the age of ‘generative advertising’, adtech infrastructure requirements are evolving rapidly. Companies like WPP are already fulfilling this need by partnering with tech giants like Nvidia to successfully capitalize on generative AI-enabled advertising campaigns.

The potential for AI to personalize advertising is huge too, and this year all signs point to a renewed focus on hyper-tailored output. Able to compile more comprehensive, real-time insights into customer preferences, it’s likely that personalization at scale will be far easier to achieve moving forwards.

The latter half of 2024 saw increased deal activity in the adtech space, which has given hope for continued momentum this year. Many adtech vendors are broadening their marketplaces through consolidation to counteract slimming profit margins. And with the change in the U.S government, many adtechs believe that more activity is on the horizon, particularly in response to anticipated deregulation.

After a period of stagnation, decision makers are calling for action and there is a renewed push towards investment despite continued economic uncertainty. It’s a move that can only signal positive times ahead.

With talk of innovation also comes the realization that change in the adtech space is expensive, particularly given the focus on a quick time to market and the issue of handling vast quantities of information. Programmatic advertising platforms process incredible volumes of data, meaning that infrastructure is one of the sector’s biggest overheads.

With that in mind, balancing operational expenditure with sustained growth is a continued priority and often this comes down to optimizing at the infrastructure level. It’s no secret that some adtechs are faced with extremely high compute spend in hyperscale cloud, yet forecasting it is both challenging and time consuming.

In 2025, we’ll see more adtechs turn towards cloud FinOps as part of efforts to consolidate infrastructure spend within their existing hyperscale stacks, as well as more digital advertisers considering full or partial migration to hyperscale cloud alternatives.

As the likes of Netflix and Amazon Prime continue to shape audience streaming trends, the last few years have given way to the rise of CTV and over-the-top (OTT) advertising. It’s unsurprising then that CTV ad spend is predicted to grow 10% annually between now and 2027, and to almost double in the UK by 2028, with adtechs looking to take full advantage of the appetite for streaming services.

Given CTV and OTT ads work primarily on first-party data, challenges around ensuring viewer privacy are far less prevalent. This, coupled with the potential to reach highly targeted audiences and the potential to achieve strong engagement rates, makes CTV an attractive route for advertisers. In 2025 we’ll likely see more adtechs consider CTV and OTT ads across a range of innovative cross-device strategies.

So there we have it. Those are my predictions for the top adtech trends in 2025. These trends may not be surprising (or even new). But what we can anticipate is a good level of momentum across the industry throughout this year. Momentum fueled by AI’s continued role in shaping change for adtechs, a renewed positivity when it comes to investment, and Google’s all-important next move for its cookie policy.

What are your 2025 adtech predictions? Get in touch - I’d love to hear them.

In an industry defined by constant innovation, Adtech specialist Bradley helps customers realise their strategies with reliable, scalable infrastructure.

He’s a Reading FC and F1 fan, and father of two.