Mobile gaming is the most lucrative sub-sector within the gaming market.

In 2018, revenue from mobile games overtook PC and console combined. The pandemic helped skyrocket that lead, peaking at a huge 60% share of the gaming market. Despite the market levelling out in later years, mobile gaming made up nearly half of the industry in 2023. By 2029, it is expected to be worth $164 billion - a step up from the $100 billion of today.

One of the biggest trends driving this incredible financial growth is the increasing number of smartphone and tablet owners around the world, with the amount of smartphone users growing from 3.94 billion in 2023 to 4.48 billion in 2024.

This trend is particularly relevant to the developing world. Especially those countries with a harsh disparity in wealth levels, such as Turkey, Brazil or India. An increasing number of people in emerging economies are using smartphones for personal computing, social media and of course, communication.

The fact that games are a secondary feature on mobile devices means that a colossal audience that traditionally wouldn’t be considered ‘gamers’ have discovered and entered the mobile gaming market. Traditional video gaming is a luxury that most residents of these countries cannot afford and mobile games go a long way to making gaming far more accessible.

In this blog, we’ll be looking at the main barriers to video game adoption in emerging markets, the growing mobile gaming opportunity and who’s already taking advantage of it.

There have traditionally been two main barriers to the success of the gaming market in developing countries.

Gaming is a privileged hobby. While gamers bemoan the rising cost of games in the western world, in developing countries the issue is even more prevalent.

Lower consumer spending power and complex supply chains mean that gaming companies aren’t incentivized to pay expensive export costs to ship the latest consumer technology such as the PS5 to these markets.

Did you know that the most popular games console in the world by sales is actually still the PS2? Sales for current generation PS5 and Xbox Series X/S are both over 100 million units shy of challenging this title. And the PS4 - notable for its phenomenal sales figures - still undersold the PS2 by 40 million units.

In South Africa it took 13 years for the PS2 to be sold at a discounted rate. In many countries today, it’s still often the only console hardware that fledgling gamers can get their hands on semi-affordably.

This means that it can be years before a developer’s new game that’s designed to run on modern hardware has the chance to reach these markets. Even in markets where a gaming industry does exist, penetration remains low. Gaming in India and Brazil is still a popular pastime for many, but wealth disparity means only a low portion of the population has access to hardware capable of running games.

PC games are typically less hardware-restrictive than those designed exclusively for consoles. Even if you only own a cheap, low-spec laptop, you can usually find a title to run on your system. Regional pricing strategies should in theory allow players in developing countries to afford games, but in reality this isn’t often the case.

If price points for games were directly converted over to local currencies from US dollars, gaming would be far too expensive for the average gamer to afford. For example, in 2021 games journalist Artura Dawn reported that in Colombia, the non-regionally priced Sims 4 plus all of its expansions would cost a million more Colombian pesos than a motorcycle. Rather than pricing out their player base, many developers opt into regional pricing to reflect metrics like local consumer purchasing power and price indexes.

Screenshot from Dead Cells developed by Motion Twin © image source

Sadly, gamers located in countries where games are more expensive – such as the west - often dissuade proper regional pricing by abusing the system with VPNs. Indie developer Motion Twin in August 2022 had to raise the price of its title Dead Cells in Argentina and Turkey thanks to regional pricing abuse. The percentage of sales for Dead Cells was around three to four times the actual player base in those countries – players were masking their location to get the game at a far cheaper rate.

Ultimately, developers have final say at what price they charge for their game. But it can be tricky to determine how to set a price point in vastly differing gaming markets, so many developers and publishers lean on regional pricing recommendations such as those offered by digital storefront Steam.

Frustratingly, thanks to an update to Steam’s recommendations in October 2022 - likely down to the platform trying to curtail region-swapping - many developing countries have seen dramatic price rises, with Steam recommending a 485% price increase in Argentina, and 454% for games in Turkey. Even more established markets have been hit hard. Gaming in India is still 85% more expensive than in the west.

Regional pricing strategies are just one reason why - even if individuals have access to hardware capable of running games - the vast majority have still traditionally been priced out of the industry.

The barriers to smartphone adoption, thankfully, aren’t as onerous and developing countries are embracing it.

Traditionally, smartphone ownership has been higher in advanced economies than in emerging economies. In 2018, 76% of people in advanced economies had a smartphone compared to 45% in emerging economies.

But in the last few years, these figures have changed dramatically. Brazil, Indonesia and India are now three of the top five smartphone markets in the world, with the Indian mobile market growing even faster than the US. 659 million Indians own smartphones versus 276 million Americans.

India is a prime example of the potential that uptick in smartphone ownership has on the mobile gaming market. The Indian gaming industry has been increasing in popularity steadily, but the poverty gap has held many back from accessing the latest technology. However, thanks to the increasing availability of smartphones, the mobile gaming market has been propelled forward.

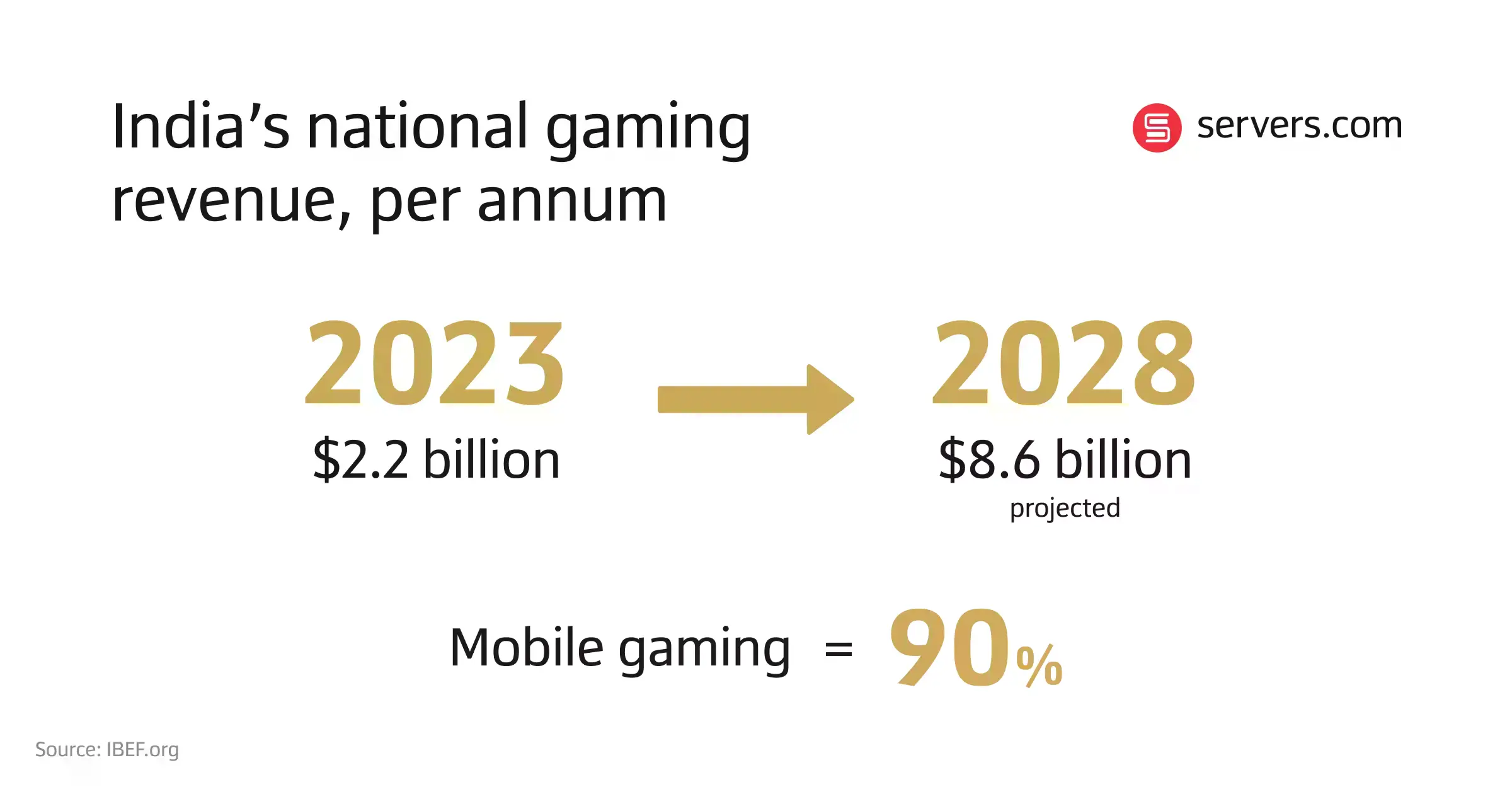

Even between 2023 and 2028, gaming in India will grow from $2.2 billion to a projected $8.6 billion, with mobile gaming holding a 90% share of national gaming revenue. Thanks mainly to India’s young population. Over a quarter of Indians are aged between 10 and 24, and it can be estimated that 75% of the population are below the age of 45, which lines up with the average global age of gamers: 35

But where is this growth in mobile gaming interest predominantly coming from?

A huge 85% of the games sector’s revenue comes from free-to-play games. And mobile games lead the market in the implementation of free-to-play pricing strategies.

Of the top ten most downloaded apps on the google play store in 2024, every single one implemented some form of free-to-play model. Most titles opt for a strategy combining in-game advertisement and in-game storefronts.

In most mobile markets, free-to-play mobile games are among the highest grossing apps in the country. In Brazil, Coin Master, Roblox and Garena Free Fire are more popular than Disney+.

The vast majority of free-to-play mobile games can be played in their entirety without ever having to spend money, instead only offering incentives for cash such as cosmetic items for players to show off, or methods of skipping time by levelling up quicker or purchasing rarer items in an in-game store.

The popularity of these games on mobile has meant the mobile gaming market has penetrated a vastly wider audience than any other gaming sector and brings a level of accessibility to those who might not be able to afford $70 or the regional equivalent for the latest release on PC or console.

Early smartphone mobile games were either single player or asynchronous multiplayer - where a player’s turn would be recorded and sent to their opponent to beat, or uploaded to a leaderboard, such as with Candy Crush Saga’s ‘play with friends’ feature. However, synchronous multiplayer games - where gamers play live against other people, have quickly become the most popular format.

Call of Duty Mobile, a synchronous multiplayer first-person-shooter game, was one of the biggest titles of 2024 globally, with an incredible one billion downloads and more than 210 million active users. While older generation mobile games might have been able to get by on less robust infrastructure, the net code of games like Call of Duty Mobile are remarkably similar to synchronous console and PC games.

We shouldn’t assume that just because a developing nation has a severe wealth gap that internet speeds are slow and those discovering gaming won’t be able to compete with more developed nations. Increasingly,governments are making commitments to bridge the global digital divide by investing in internet infrastructure to jumpstart online industries in emerging economies.

While incredible strides have already been made in the adoption of mobile gaming in developing nations, there’s still a huge potential audience around the world for gaming that is largely untapped. It’s an area to keep a very close eye on and for some gaming companies to look at potentially investing in.

This article may contain copyrighted material which may not otherwise be owned by us. This article is made available for educational commentary purposes and we make no claim of ownership to any such material and we acknowledge the copyright owner's rights.