There are very few industries that haven’t made the move to the cloud over the last decade. The financial industry is one of the outliers that retains at least one foot, if not both feet, within dedicated infrastructure.

The slow move to cloud hasn’t necessarily been down to a lack of appetite, but the strict regulations around data within the financial industry and balancing their requirements with what cloud can offer. A report from 2017 showed that financial institutions were concerned back then about “management of data, the effective supervision of cloud providers, and concerns around data location and access” impacting their ability to move to the cloud.

As the authors of the report, Pinsent Masons and UK Finance have highlighted more recently, those concerns “have not gone away, but the barriers to cloud adoption have reduced”.

The lure of cloud is calling. Promising flexibility, scalability and efficiency, it is an attractive proposition for brokerages, and some have made or are starting to make small moves towards it.

So, is a cloud-based future possible for brokerages? Or will they always retain a presence in dedicated trading infrastructure? These are the questions we explore and look to provide some answers to in this blog.

The importance of infrastructure

Things in the trading world can change in a matter of seconds and even milliseconds. Elon Musk has shown on multiple occasions the power that a single tweet can have on the stock market. His tweet in May this year announcing that the deal to purchase Twitter was on hold caused the pre-market trading value of Twitter’s stock to drop by 18%.

It's moments like these where significant money can be made or lost. But what if the trading infrastructure solutions that a broker uses goes down right at the same moment? Traders could miss out on potential trades and the opportunity to take advantage of a key point in the market.

Because of this volatility and the need to act fast, traders will often use multiple brokers so that they have a back-up broker if the other goes down. Similarly, brokers should consider using a multi-vendor approach to ensure that when downtime happens there’s redundancy in the network and they can continue facilitating their customers’ trades.

Latency is king

Latency is the time that it takes from the moment that a signal is sent to the moment that signal is received. Lower latency means higher speeds, allowing traders to execute orders, at the displayed price, as quickly as possible.

Brokerages that invest in low latency trading infrastructure and broker hosting can gain a competitive advantage over others in the industry. Those that don’t will quickly start to rack up missed opportunities, losing money as a result. There are a few reasons for this.

Firstly, if there is even the slightest delay (we’re talking milliseconds) in the order message being routed to a broker’s server, the broker might not be able to fill the order because the price that was originally traded at has changed.

Secondly, trade slippage - the difference in the expected price of a trade vs the price at which the trade is then executed - can cause a trader to pay more than what they had originally believed they’d bought at.

The biggest factor that affects latency is how far the signal that is sent has to travel to where it is then received. It can be further determined by how many intermediate “hops” the packet of data has to make as it crosses the internet. Having your trading infrastructure in a data center as close to where trading is taking place is therefore important.

In contrast, when a trading brokerage has its servers located in the cloud, they can be punished by the high latency. There have been many cases where brokerages have been arbitraged - trading that exploits tiny differences in price to buy and sell a security in two or more markets to get a higher price - because they are in the cloud. Traders have taken advantage of the broker due to the high latency price feeds (trade slippage).

The big financial companies that brokers “plug into” have started to offer their services in the cloud. However, if you start to compare their offering in the cloud with an offering on dedicated servers, latency is greater on the cloud solution.

If there’s more latency in the cloud, why then would brokers choose to be in the cloud?

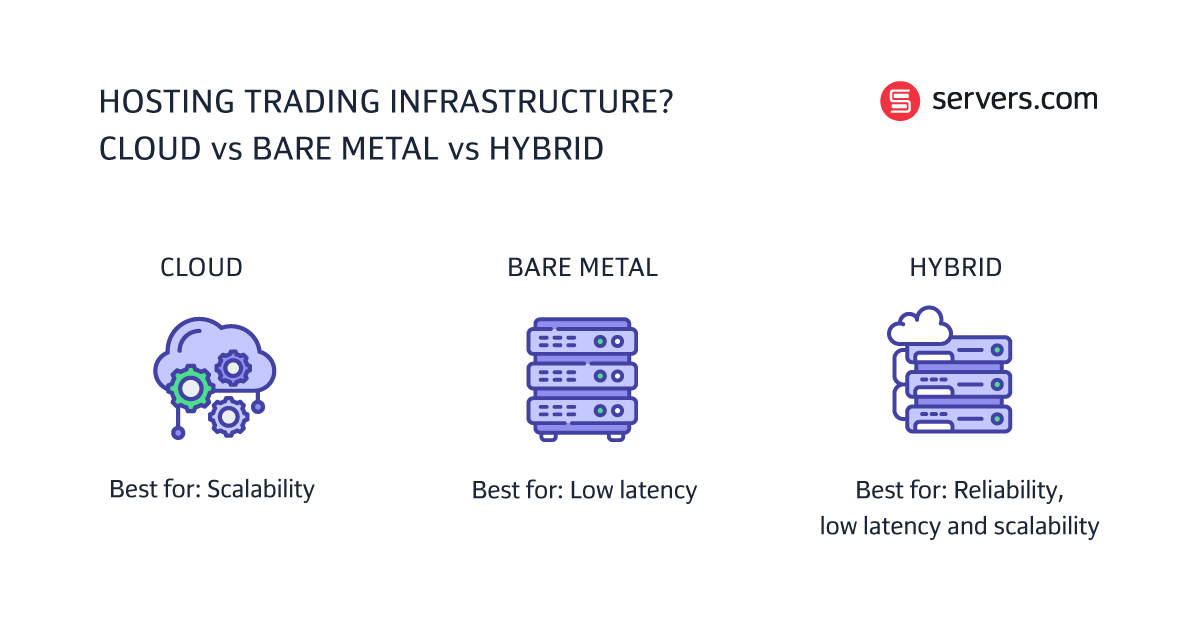

Cloud vs bare metal vs hybrid