Audio advertising has come a long way since the first ever radio commercial aired back in 1922. Today, audio advertising is fast becoming a thriving medium across digital media platforms. And it’s clear to see why. Programmatic audio holds the key to a wide range of new ad formats, from podcast to in-game ads to interactive experiences on smart home devices. No wonder it’s now the fastest growing advertising format.

But the success of programmatic audio advertising comes with new challenges too. Challenges like buyer hesitancy, growing concerns around ad fraud, and keeping up with demand. As the medium gains traction and more digital audio ad platforms seek to deploy audio ads within their product offerings, establishing a robust foundational infrastructure has become critical.

This whitepaper explores the rise of audio advertising in today’s ad ecosystem. Covering the origins of audio ads through to today’s digital audio boom, the paper delves into

Audio ads have traditionally been synonymous with live radio. But today, more and more of us are consuming digital audio content. Tuning into music streaming, podcast, gaming, and digital radio platforms is a daily activity for many. And that means opportunities for audio advertising are growing rapidly.

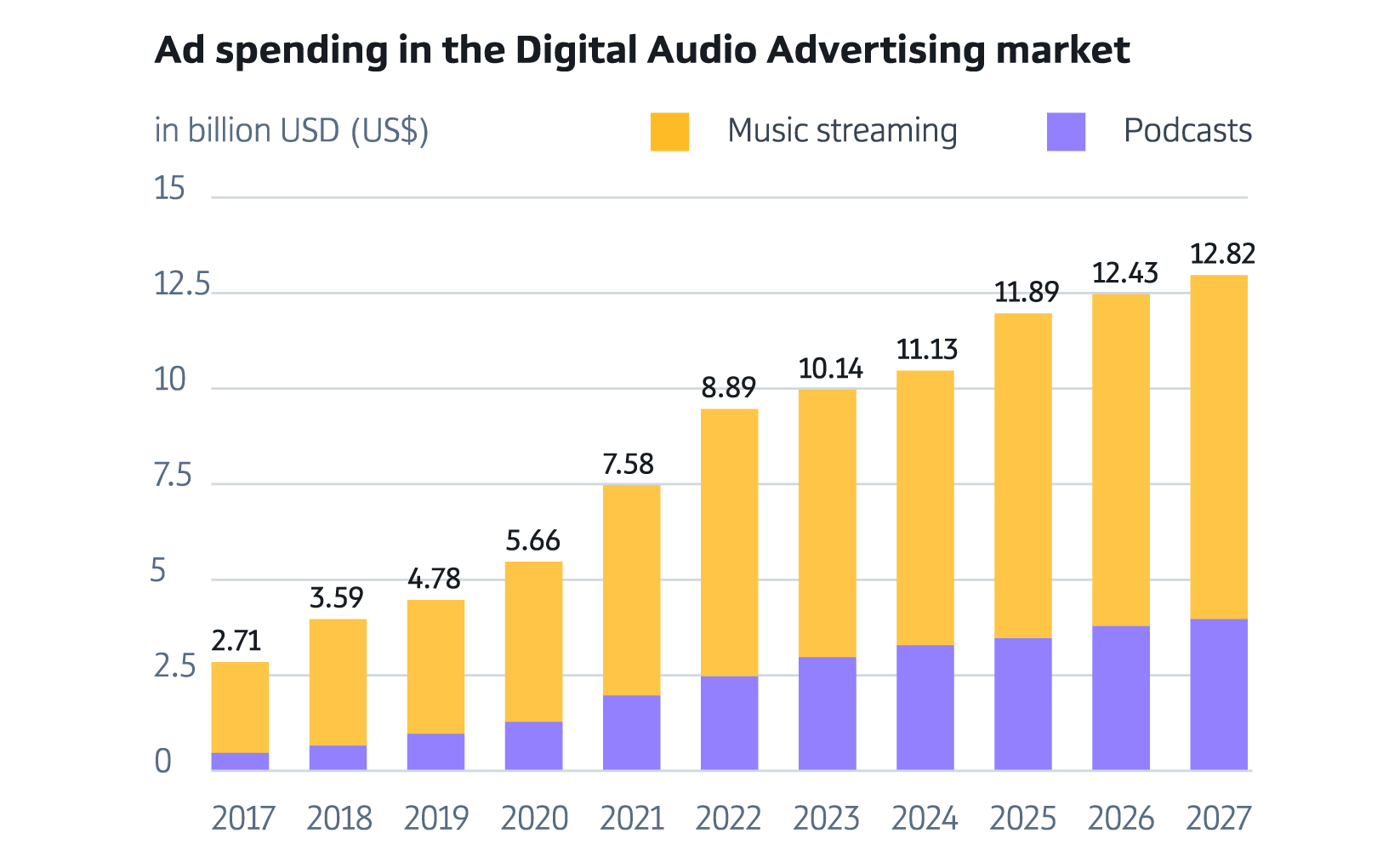

The number of Americans streaming content on digital audio platforms has more than doubled since 2012. Digital audio ad spending is forecast to experience an annual growth rate of 7.28% between 2023 and 2027 and ad spending in the audio advertising segment is projected to reach $38.75 billion by the end of 2023. Audio is currently the fastest-growing advertising format and the number of brands introducing audio ads into their marketing strategies is shooting up rapidly.

Worldwide, the number of people listening to digital audio ads is expected to reach 1,632.9 million by 2027 (231.2 million in the U.S. alone). In Australia, 75% of media agencies now regularly include streaming digital audio advertising as part of their offerings with 70% consistently deploying podcast advertising.

AT&T aired the first ever paid radio commercial on August 28, 1922, on a New York radio station called WEAF. The first commercial to hit the airwaves was a real estate ad by Queensboro Corporation New York, at a cost of $50 for a series of five programs. And from that moment on, broadcast advertising as we know it today was born.

The business concept was as simple as it was innovative. Radio could sell time. “Time measured in exact minutes and seconds on a communication system for hire”, as reporter John McDonough aptly puts it.

Skip forward to 2023 and audio advertising is experiencing a second renaissance, fueled by the booming popularity of streamable audio content. These days audio ads are being delivered via online streaming platforms such as Spotify and YouTube, podcast platforms like Acast, and as part of in-game ad placements.

Streamable content is all around us. Listening to music on the go or whiling away the morning commute accompanied by a podcast are commonplace activities for most of us. In 2022 alone Spotify generated an estimated 1.4 billion U.S dollars in advertising revenue and this figure is set to increase to 2 billion by 2026.

Spotify platforms digital audio ads of between 30 and 60 seconds each. The ads are placed between songs and during podcasts. And whilst Spotify is currently the global leader in music and podcast consumption, there are many other channels embracing audio ads too. Channels like Apple Music, Stitcher, Sonos, YouTube, and Amazon Music.

It’s not hard to understand why. Digital audio advertising is more accessible than traditional broadcasting. The medium broadens audience reach and provides advertisers with highly granular targeting opportunities. With digital audio, advertisers can place their ads directly where their audiences are - alongside select podcasts, artists, or digital radio shows that share similar audience demographics.

Direct audio advertising is a manual process. Buyers negotiate on audio ad inventory (the advertising space a publisher has available and puts up for sale) before serving it on their desired platform. The prices of ad inventory and ad space are flexible and direct negotiations lend themselves to sourcing premium inventory. But buying and selling directly can be slow and expensive. Cost per thousand impressions, otherwise known as cost per mile (CPMs), is typically high since each ad placement is bespoke to the individual buyer.

Programmatic audio advertising is an automated process. Ad inventory is purchased and exchanged online via real-time bidding (RTB). Bids are placed simultaneously in programmatic auctions with the highest bidder winning the inventory slot. Programmatic requires no person-to-person negotiation. An advertiser will just set various parameters such as budget, ad placement, and audience preferences for their campaigns.

Programmatic advertising has seen great success across ad types. It’s now the preferred advertising format for digital audio transactions. So much so that 93% of publishers and close to three-quarters of media experts now choose to transact audio ads programmatically.

But there’s a lot to learn. According to Joshua Wilson, Commercial Director of Japan and Asia Pacific at Crimtan, streaming platforms like Spotify and Acast should be trying to “help advertisers understand the benefits of the channel and the right approach to make audio buys”.

Programmatic display advertising has already seen great success and the market is forecast to reach an impressive $141.96 billion in the U.S. in 2023. For many years, limited publisher interest in programmatic audio and the absence of suitable technologies for cross-platform delivery kept investment in the medium relatively low.

But in 2014 the Interactive Advertising Bureau (IAB) created a new ad-serving protocol, and this all started to change. The Digital Video Ad Serving Template (otherwise known as VAST) created a shared language for advertisers and publishers. And in 2018, a new “adType” attribution was introduced to support audio-only advertisements.

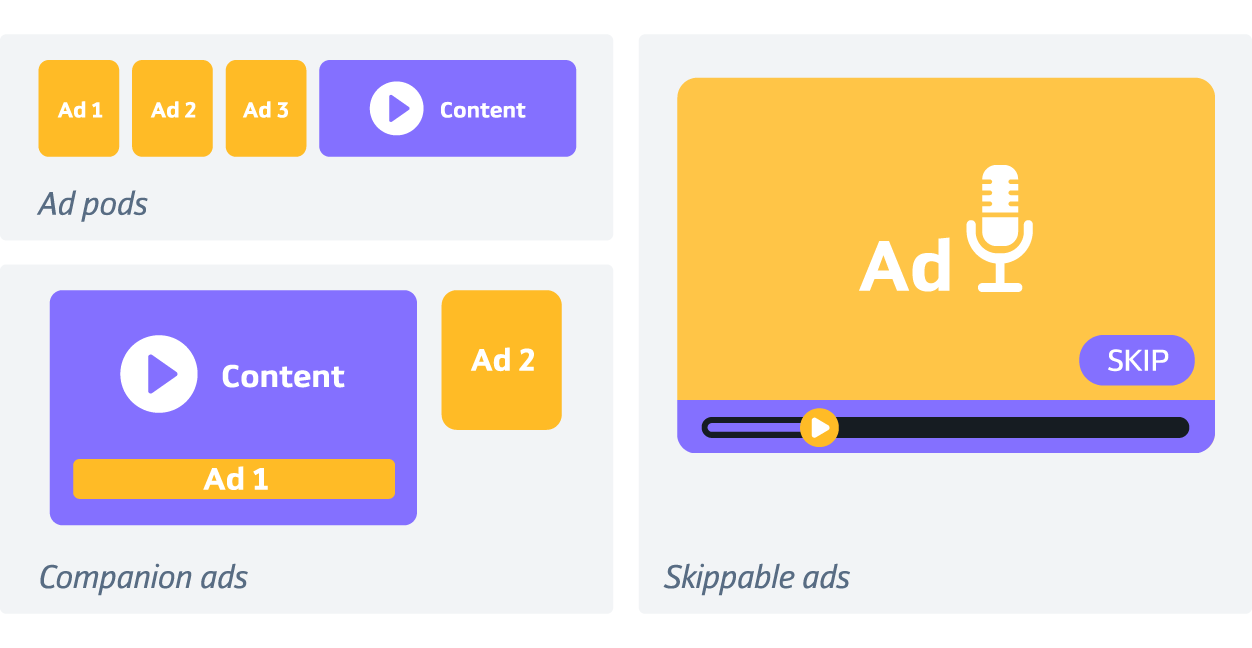

Within the adType attribution, audio ads could take three different forms: companion ads (banner ads displayed alongside an audio ad), ad pods (audio ads distributed across set slots within content), and skippable ads (pre-roll and mid-roll audio ads).

VAST paved the way for the adoption of programmatic audio advertising on a much greater scale. Even though the growth of the medium has been gradual, its impact is undeniable. Today, digital audio content is nothing short of pervasive. Its effectiveness is finally receiving the recognition it deserves and, increasingly, companies like Google, Acast, Pandora, and Rubicon are starting to incorporate programmatic audio ads within their platforms.

A recent study tracking national advertisers found that moving just 1.2% of ad spend to audio resulted in up to 23% more return on ad spend (ROAS). The study also found that across top performing ad categories, adding audio ads impacted sales by up to 83% by making other media, such as TV, out of home, and video advertising, work harder.

Further research surveying news radio campaigns found that advertisers combining radio, podcast, and livestream in audio campaigns realized the highest levels of brand lift performance at +17.3%, with audio campaigns generating twice as much brand lift compared to traditional online display ads.

So, what exactly is driving these impressive results?

The number of people paying for subscriptions to streaming services reached 46% in 2022. And not only that. People are investing a lot of time on these platforms. Between 2021 and 2022 the amount of time people spent listening on average each week increased from 18.4 to 20.1 hours.

Digital audio is immersive, engaging, and personal. Research conducted by Spotify and Neuro-Insight found that digital audio is more engaging than radio, TV, and social media. Using steady state topography technology to measure brain activity in real-time, Neuro-Insight found that some types of sound have a stronger impact on the brain than others; namely that listening experiences on digital audio led to higher instances of memorability, engagement, and emotional intensity, than radio.

One reason for this could be the way we consume digital audio. Audacy found that people typically listen to podcasts when alone and therefore free from external distractions – something that is not the case for other types of broadcast or streaming media which listeners engage with across various listening occasions.

Most listeners consume digital audio content whilst wearing headphones. That means, unlike other mediums, audio ads demand the listener’s attention in full. Audio advertising is “an engaging, one-to-one form of communication” and “gives brands the opportunity to build a relationship with the listener,” according to Founder and CEO of AdTonos, Michal Marcinik.

Looking ahead, interactive voice recognition technologies like Siri, Alexa, and Google Home have the potential to strengthen ‘bonds’ with listeners even further by facilitating two-way dialogues and turning purchases into conversations.

As well as forging connections, research shows that digital audio ads boost positive perceptions of brands which, in turn, encourages listeners to place purchases. A Guardian-backed study in partnership with independent research agency, Tapestry, found that “podcast advertising commands the highest levels of attention of any media channel” and that “65% of listeners paid attention to podcast adverts - more than adverts on TV at 39% and adverts on the radio at 38%”.

Memory for short audio ads has been shown to be high. Data indicates that audio ads of 10 seconds or less effectively raise awareness of brand names, product names, and company locations, and that “audio ads may leave an impression even when the listener is engaged in other tasks, such as driving or playing a video game”.

Because audio ads are placed contextually, the medium lends itself to highly granular targeting. For example, advertisers can choose to feature their ads alongside artist channels, podcasts, or radio shows that resonate with the interests of their target consumers.

Acast has even introduced keyword targeting to its marketplace. With this feature, advertisers can “align their message with the most contextually relevant content spoken about within an episode [which] significantly increases targeting relevance, reduces wastage, and results in a more contextually relevant advertising experience for listeners”. Using the feature, advertisers can target specific contextually relevant conversations within shows – even if the show itself lies in a different topic category.

And that’s important given that contextual advertising is likely to become an essential tool for advertisers amidst cookie depreciation. VP of Sales EMEA at StackAdapt, Andrew Rose, agrees. “It’s more important than ever for marketers to introduce cookieless targeting methods to their digital strategies [and] one of the most prevalent forms of cookieless advertising is contextual advertising” comments Rose.

We live in a mobile-first world and digital audio advertising fits perfectly into the mold. Most audio content is listened to on mobile phones and the amount of time we’re spending consuming audio content on our phones has near tripled since 2014. Edison Research revealed that smartphones now significantly outnumber desktops and laptops as the device type used for podcast listening.

It also helps that there are a wide range of platforms available where audio ads can be published. In addition to music and podcast streaming platforms, smart speakers, video games, and video streaming platforms like YouTube are also prime candidates for ad space. YouTube made audio advertising available to global users in 2022 across Google Ads, Video 360, and Display. Now advertisers can reach wider audiences, and users can choose whether they prefer to watch a visual ad or listen to an audio ad.

As programmatic audio ads see more success, we’re set to see even more advertisers and publishers prioritizing audio. The shift is already notable with new audio advertising trends steadily emerging.

Trends like:

Interactive audio ads are hotly anticipated as the next big thing in audio advertising. It was forecast that the worldwide smart speaker market experienced an annual growth rate of 7.1% between 2022 and 2023.

As more of us put smart speakers in our homes it’s probable that the delivery and consumption of interactive audio ads (where listeners make purchases by conversing with their smart speakers) will increase.

YoursTruly by AdTonos is a solution making real-time interactions between listeners and advertisers via smart speakers a reality. With YoursTruly, listeners can make purchases directly from audio ads via voice command. At present, the solution is compatible with mobile devices, Echo devices, and smart speakers with a voice assistant enabled.

A study comparing consumer engagement between voice assistant conversations and broadcast radio ads found that branded smart speaker ads trigger a 25% increase in overall brain activity when compared to branding in standard audio ads.

The study also found that engaging in a conversation with an ad via a voice assistant makes branding moments 11% more memorable to the consumer. Commenting on the findings, Tilly Sheppard, Product Manager at Xaxis remarks “whether advertisers are looking to improve brand consideration or drive both low and high consideration purchases, interactive audio ads help to cut through”.

In 2022, self-serve advertising platform, AdsWizz became the exclusive programmatic sales representative of Sonos Radio advertising inventory. Sonos is a market leader in the global smart speaker market, with 14 million households using Sonos products in 2022. Sonos Radio is the company’s most listened-to service.

The agreement means that Sonos will be able to use AdsWizz’s state-of-the-art audio technologies and sales channels (including AdsWizz’s own demand-side-platform, marketplace, and direct integrations with third-party DSPs). In return, AdsWizz’s advertisers gain access to Sonos’ audio inventory.

Game developers have a reputation for being cautious of ads. And understandably so. Their players don’t want disruptions or distractions during games. The threat to the player experience has historically left developers steering clear of any mention of ads altogether.

But what if there was a medium that wouldn’t disrupt gameplay. Would gamers accept ads then?

With audio ads, advertisers can reach gamers without causing unwanted distractions or interrupting gameplay.

There were 3.03 billion video gamers worldwide in 2022. If audio ads are palatable for gamers, that’s a massive opportunity. And the gap in the market hasn’t gone unnoticed. Ad platforms such as Targetspot, AudioMob, and Odeoo have started to emerge as leaders in the non-intrusive advertising sphere.

In 2022, Odeeo, an in-game audio ad platform, announced that it would be integrating with advertising marketplace Xandr. The integration, which allows demand-side platforms (DSPs) access to Odeoo’s mobile game inventory, is one of the first of its kind. Innovations such as this make it possible for advertisers to capitalize on the casual games market, complete with a full view of traffic sources and viewability.

“In-game audio is the best way for advertisers to get attention.”

With the intrusiveness issue circumnavigated, a multitude of possibilities come to the fore. Games lend themselves to heightened personalization, gamification, and reward methodologies, all of which improve engagement. For instance, players might be rewarded for listening to audio ads with a prize, the ability to ‘level up’, or unlock a new feature.

“What excites me about in-game audio ads is the huge potential to create immersive, engaging content that resonates deeply with users” comments Sally Keane, Spotify’s Head of Enterprise Sales for Northern Europe. “As the video game industry continues to grow, there’s enormous potential for brands to reach this leaned-in, attentive audience,” furthers Keane.

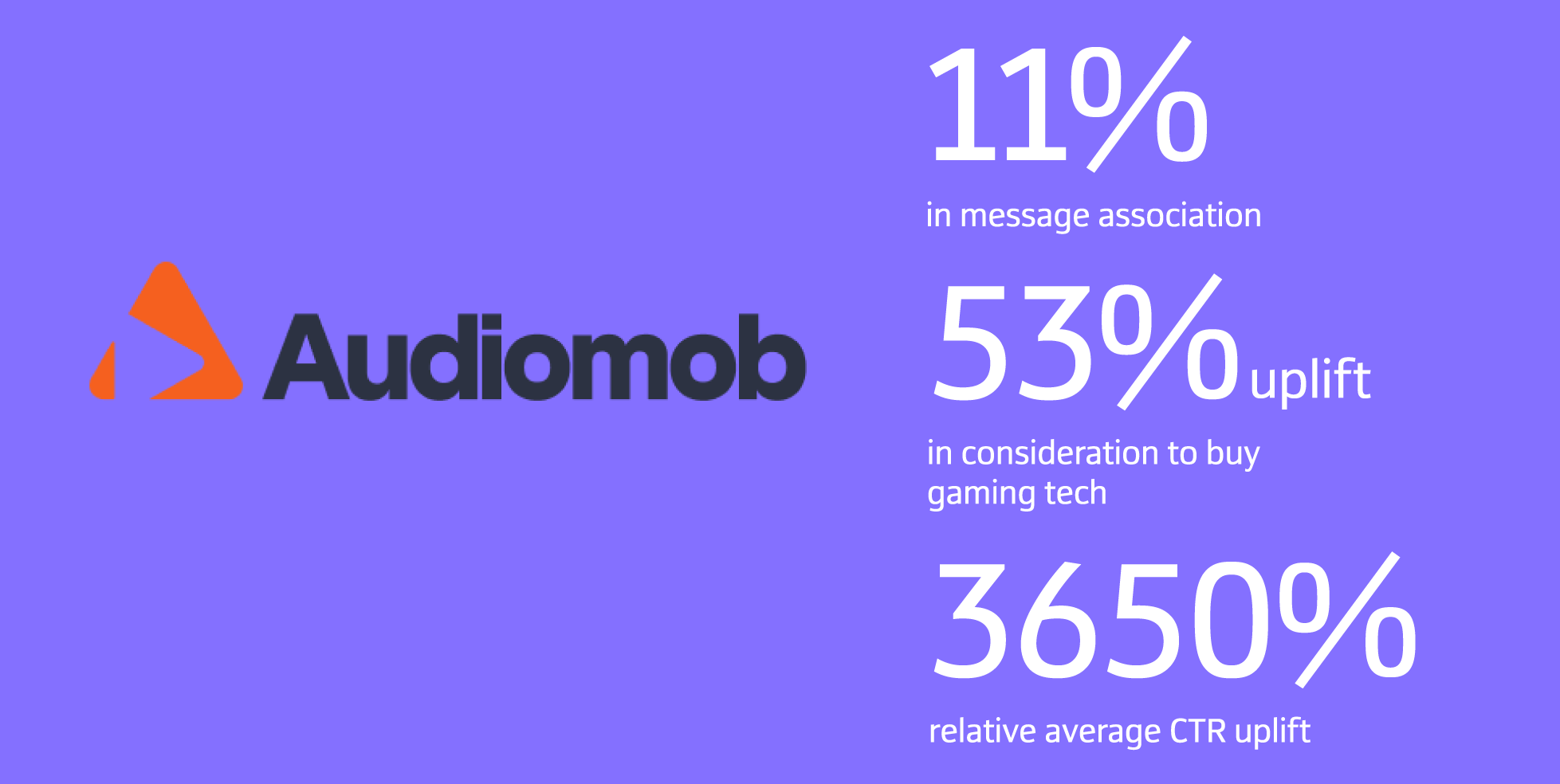

One ad platform embracing in-game advertising is Audiomob. Audiomob helps brands and artists connect with audiences with in-game audio ads that don’t disrupt gameplay. Founders Christian Facey and Wilfrid Obeng started the company after noticing the boom in audio advertising caused by big players like Spotify and got their first pool of funding in 2020. Now Audiomob is looking to expand its offerings into the wider app ecosystem to become, as Facey describes, “the ultimate audio content delivery platform”.

As reported in an Audiomob case study, Currys and Xbox have embraced the in-game audio format resulting in some impressive metrics. These include an 11% uplift in message association, 53% uplift in consideration to buy gaming tech from Currys, and a staggering 3650% relative average click-through-rate (CTR) uplift.

Founded in 2019, Gadsme is a global in-game ad platform for the gaming and e-sports industries. Gadsme’s in-game ad monetization platform, Audio Ads, allows programmatic and direct advertisers to run targeted, worldwide campaigns within any video game.

The audio ad format includes three in-game audio formats: mutable audio ads, rewarded audio ads, and location-based triggered 3D audio ads which trigger non-intrusive audio ads when a player moves into the predefined geographical radius within a game. The ads are delivered seamlessly so do not disrupt the player experience and players are rewarded for visiting the set location to listen to an audio ad. Gadsme has now partnered with Targetspot to support growth and inventory fulfilment, maximize revenues, and campaigns.

And when it comes to industry uptake, Chief Revenue Officer at Gadsme, Simon Spaull is noticing massive traction: “We’re now seeing a big uptake in gaming companies wanting to explore non-intrusive ad formats, as they heavily rely on advertising revenue, and audio is now a part of this”, comments Spaull.

Audio ads aren’t set to replace other forms of digital advertising outright. Instead, audio advertising lends itself to a connected media approach. Ads don’t often drive immediate conversions so advertisers are better served by incorporating audio as part of a broader, omnichannel advertising campaign.

Connected media campaigns are based on the interconnectivity of various media platforms. An advertiser adopting a connected media approach will serve an audio ad alongside a video ad or connected banner ad to reinforce messaging and encourage engagement.

Various platforms, including Spotify, are already adopting a connected media approach. Spotify’s audio ads, for instance, are accompanied by supporting display ads and companion banners, sporting the brand’s name and a call to action (CTA) button.

Some digital audio ads are ‘backed in’, meaning they are added as part of the original audio file. An audio ad that is inserted dynamically into a podcast is essentially an advertising segment that is independently produced and recorded. Dynamic audio ads are inserted into an episode when a user who meets the required targeting parameters downloads the content. This is called server-side ad insertion (or SSAI).

There are numerous advantages that come with SSAI. Namely, it affords more room for customization. By shifting to a dynamic approach, advertisers can serve different ads to listeners of the same podcast episodes. Or, vice versa, serve the same ad across different podcast episodes depending on predetermined parameters such as the user’s location or the type of device they are listening from.

Tap Live is an audio advertising solution by Triton Digital that facilitates the monetization of live audio content through dynamic ad insertion. Tap Live is used by broadcasters to monetize digital audio inventory along with campaign trafficking and reporting capabilities. The latest version of Tap Live provides flexible campaign set-up, creative management, advanced ad separation, and campaign targeting.

Nova Entertainment is an independent audio entertainment business using Tap Live. Tim Armstrong, Nova’s Director of Digital Capability and Data, comments “with tap we are able to streamline our audio campaign management to drive operational efficiencies, enabling us to deliver the audio entertainment experiences our customers have come to love and expect”.

The success of audio doesn’t come at the expense of video streaming platforms like YouTube, Dailymotion, and Vimeo. In 2022, the global online video platform market drove over 80% of total internet traffic and the market is forecast to reach a value of 22.14 billion dollars by 2028. But imagine what could happen if the two were combined?

Well, that’s exactly what some platforms are doing. In 2021, DailyMotion, in partnership with Targetspot, commercialized a new audio roll format facilitating the insertion of audio into online video. Last year, YouTube also rolled out audio ads to its advertisers.

“Giving advertisers the ability to target the on-line video viewer with an audio format in addition to traditional audio channels, allows them to cover the entire user journey and thereby multiply the impact of their campaigns,” says Bichoi Bashta, Chief Revenue and Business Officer at DailyMotion.

Whilst audio advertising is making strides, there are obstacles still to overcome. Despite the glowing appeal of audio ads, incorporating audio into a landscape dominated by programmatic advertising is still proving challenging.

Programmatic is still relatively new to the audio advertising ecosystem. And this impacts adoption. Some podcast buyers are resistant to purchasing audio ads through programmatic channels. In 2021, the percentage of podcast spend going towards programmatic buying represented just 2% of total podcast spend, and whilst this is set to increase, it’s expected to account for no more than 10% of U.S podcast spending by 2024.

Buyers remain wary of programmatic and certain ad formats (namely host-read ads, custom ads, and larger buys) are still largely bought directly. For many it comes down to one thing. Trust.

Kristen Coseo, director of podcast and digital audio strategy at Ocean Media agrees. She states that the majority of the reps Ocean Media works with are longstanding connections, “so the trust is there”.

The technologies that drive programmatic advertising platforms were not made for audio. Most were designed with visual ads in mind. And that means that audio ads aren’t always compatible with existing ad-buying formats, ad servers, and exchanges. Just think about the terminology associated with programmatic processes (cost-per-click, impressions, views, etc.,). Audio advertising requires a new vocabulary and a new set of processes.

Some media professionals have vocalized reservations about potential digital audio ad fraud. Integral Ad Science surveyed digital media experts and found that 87% were concerned or very concerned about ad fraud in audio. Ad impression fraud schemes targeting audio inventory like the “BeatSting” attack – which cost unprotected advertisers as much as one million dollars per month – have understandably shaken confidence.

That said, media experts remain hopeful that these security challenges can be overcome through adequate third-party verification processes. Advertisers will need to explore new ad fraud prevention techniques to mitigate risk.

The opportunities for digital audio advertising in today’s ad ecosystem are huge. Audio ads are proven to be engaging, memorable, and lend themselves perfectly to integration across a diverse range of platforms.

But for digital audio advertising to reach its ultimate potential, some existing barriers to adoption remain to be overcome. Namely buyer hesitancy, a residual preference for direct deals, and concerns surrounding ad fraud prevention. Despite these initial stumbling blocks, the potential benefits are too good to ignore.

One thing’s for sure. The future looks bright for audio ads.

This article may contain copyrighted material which may not otherwise be owned by us. This article is made available for educational commentary purposes and we make no claim of ownership to any such material and we acknowledge the copyright owner's rights.