The topic of centralization vs decentralization is a bit of a hot potato in the crypto and blockchain space.

Decentralization is one of the key goals of the original crypto dream. It therefore remains revered amongst the more die-hard enthusiasts of disrupting traditional finance and the centralized organizational control that underpins it.

Layer1 blockchain Radix explained the driving force behind this goal, saying - “the desire for decentralization springs from a fundamental desire for antifragility. For some this is about a distrust of authority. For others, it is about creating better systems for storing human wealth.”

Many cryptocurrencies and blockchains sell themselves on their ability to offer decentralized finance and services. If you look closely, however, you’ll spot flaws in their decentralization promise.

And that’s because true decentralization isn’t easy to achieve.

“100% decentralization is more difficult to achieve than some in our industry would care to admit,” said Kevin Chou, co-founder of SuperLayer.

In this blog, we take a look at the difference between centralization and decentralization, where unintended centralities continue to exist within blockchains and cryptocurrencies, and why achieving true decentralization requires sacrifice.

Centralization is at the heart of governments, organizations, institutions and structures that underpin society. Even the current state of the internet is centralized. But what does that mean?

As the name suggests, centralization is the allocation of control to a single authority, such as a company or person. Because the internet is centralized, it means that all our data is stored on servers that are owned and controlled by a small number of organizations. This exposes data to threats from hackers, and those wanting to censor certain information or use data to track people. It creates a single point of failure.

Client-server architecture: Most centralized infrastructure is based on client-server architecture, meaning that a central system or device acts as a server. Clients (other devices or systems) connect to the server to request data or receive services.

Greater control and visibility: Monitoring of the flow of network data within a centralized environment is carried out by a centralized server, giving companies greater control and visibility over the network and where data is.

Improved data flow: By having one source of truth when it comes to data, it can help with breaking down siloes of information to enable collaborative thinking.

Centralized infrastructure management: By working with one hosting provider, a company only has to manage one relationship, one set of contracts and one infrastructure bill.

Accountability: With the buck stopping with one hosting provider, accountability is clear. It’s a powerful force for the one in charge to do the best job possible.

Cost-efficiencies: Centralized hosting can benefit from economies of scale. For instance, standardized processes and policies reduce administrative expenses and centralized buying will bring discounts and lower shipping costs

Increased vulnerability: Since data is stored in one place, with one provider, it makes it far more vulnerable to individuals, organizations and even countries accessing and using that data.

Single point of failure: If centralized infrastructure goes down, it can take down an entire business or organization’s network leading to loss of service.

Limited scalability: A business’s ability to scale relies heavily on its ability to scale its infrastructure. By centralizing infrastructure, scaling can only take place at the speed and availability of the hosting provider. Similarly, a business is limited to the hosting provider’s data center locations.

Vendor lock-in: Designing infrastructure within one hosting providers ecosystem can make it very difficult to diversify hosting or move infrastructure to another provider.

Centralized cryptocurrencies and exchanges - one entity oversees and controls all transactions that take place, as well as oversees rules, fees and the future of the coin.

Binance and Coinbase are two examples of well-known centralized exchanges. When asked recently about the benefits of centralization vs decentralization, Binance CEO Changpeng Zhao said, “between being decentralized and potentially losing your coins, or using a centralized service that keeps your coins, most people today still choose to use a centralized exchange (CEX). That’s why a centralized exchange is more popular today. A centralized exchange provides an incremental step for users to access crypto and can act as a bridge between centralized and decentralized systems.”

Centralized stablecoins - such as USD Coin (USDC) or Tether (USDT), which maintain vast reserves of cash and cash equivalents off-chain to ensure that their coins are always worth $1. By having a pegged value like the U.S. Dollar or another currency, the aim of stablecoins is to help reduce volatility while still delivering on the concept of digital money that can be easily transferred between centralized exchanges. It also protects investors and traders from market swings.

Because of this approach, centralized cryptocurrencies charge a larger fee per transaction than their decentralized counterparts. Decentralized cryptocurrencies can charge much lower fees because they remove the intermediaries that centralized exchanges use and which earn their cut through the transaction fees.

Decentralization, as you may have guessed, is the opposite of centralization and is closely linked to the rise in Web3, of which it is a crucial component. Decentralization represents a paradigm shift in the structure of organizations and delivery of services.

Decentralization is the idea of moving away from centralized authorities and distributing control between a network of participants. It is the foundation on which the world of Web3 and a more democratized approach to organizational structure has been built.

“As long as a single center has a monopoly on the use of coercion, one has a state rather than a self-governed society”. This was said by American political economist and Nobel Prize-winner Elinor Ostrom back in 1990 and is a great explanation for why the concept of decentralization is becoming increasingly popular, particularly within the world of alternative finance.

Peer to peer network: In a peer to peer model, nodes or computers within a blockchain network are connected to each other, rather than a central server, to create a mesh network. Each node performs the same tasks and holds the same amount of power as each other so there is no hierarchy.

Trustless: A decentralized blockchain removes the need to rely on third parties for ‘trust’. Instead, all participants within the blockchain come to a consensus on a single truth, which is then placed into code. Take Bitcoin for example, it is a system that allows anyone to participate in validating transactions on the public ledger. While the term ‘trustless’ is used to describe a decentralized blockchain it does in fact require a level of trust, but that trust is distributed.

Transparency: Decentralization means that no single entity has complete ownership of information or data. And because that information is stored on a decentralized public ledger, it can be transparently viewed by anyone.

Innovation: Opening up decision-making and planning to anyone, breeds greater innovation than relying on the perspectives of a small group of people.

|

Functionalities |

Centralization |

Decentralization |

|

Control |

One single point of control |

No single point of control |

|

Security |

One point of failure so easier to hack |

No single point of failure, making it harder for hackers to access information because it is distributed across the network |

|

Decision-making |

Bureaucratic, less creative, less diverse and slow but benefits from one, focused vision |

Shared across participants in the network |

|

Transparency and trust |

Requires third party ‘trust’ of information |

Information is stored on a public ledger and can be viewed by anyone. Trustless network, removing the need for third party validation |

|

Cost |

Expensive to set up and maintain with high overheads |

Cheap to set up but cost of maintenance is high |

|

Innovation |

Less diversity of opinion and slower response to new situations or changing conditions |

Creates opportunities for collaborative thinking but lack of regulation could hold back the implementation of innovation |

|

Privacy |

Extensive personal data is collected opening it up to access |

Consumers and organizations have full control over their information |

“The blockchain symbolizes a shift in power from the centers to the edges of the networks” - William Mougayar, Chair, Kin Foundation.

As Mougayar so eloquently said, at its heart, decentralization is about taking power away from the few and distributing it among the many. There are a few key benefits to that approach, including:

Independence: The collapse of FTX at the end of 2022 showed the world what happens when a central authority becomes compromised. A system without a single, corruptible controller and the independence that brings is far more likely to provide better protection for your assets and investments.

Security: Decentralized blockchains require more than 50 percent of the nodes within the network to work together to take over the system, which makes it hard for that to happen. If a bad actor did decide to try and attack a single node, the impact on the rest of the system would be minimal.

Safety in numbers: An important feature of blockchain technology is its ‘trustless’ connections. What that means is that thousands or millions of devices work together to verify transactions accurately, rather than relying on a single device that could easily be compromised.

Privacy: Because the blockchain technology on which cryptocurrencies rely on store information about wallets only and not individuals, you don’t need to worry about an audit trail that holds private information. This is particularly attractive to investors who want to operate outside of the traditional, centralized finance systems that govern so much of what we do with our money and how much our money is worth.

Regulation: There’s no doubt that Web3, crypto and decentralization are driving exciting innovation in different areas of society, economics and industries. But regulation is struggling to keep pace, creating a lot of uncertainty for many around decentralization.

Fragmentation: In a decentralized network or environment, different platforms and groups can struggle to communicate with each or work effectively together. Information can become siloed. This can be particularly challenging when coordinating big projects where there is no central authority overseeing it.

Closed-mindedness: The communities that decentralization creates are incredibly powerful in their openness for new ideas. That said, it can be easy to get sucked into one shared point of view and lose sight of alternative opinions.

Decentralized cryptocurrencies - are reliant on blockchain technology, which is a distributed ledger on which financial transactions can be recorded. The blockchain and the transactions it holds are verified by multiple independent devices, working as individual nodes in the broader system.

In direct opposition to centralized cryptocurrencies, there is no one person or authority setting the direction or taking control of decentralized cryptocurrencies. Instead, millions of participants build cryptocurrency networks and then take charge of their ongoing management.

Decentralized storage – protocols like Filecoin and IPFS (InterPlanetary File System) are changing the way data and information is stored. Rather than information being stored in a centralized repository by one entity, it is stored across multiple nodes, all connected on a peer-to-peer network.

The protocol encrypts the files and the person who owns the data holds the encryption key to ensure only they can read it. And by splitting up the information and distributing it across the blockchain network through a process called sharding, no one node holds the entirety of the information, making it much more secure.

Decentralized identity – an identity management approach that gives people or organizations full control over their digital identity. That includes data like search and buying history and usernames and passwords. It offers greater privacy and ownership and removes the need to use third parties to verify personally identifiable information (PII).

With such impressive benefits and use cases, it’s easy to see why decentralization has become such a sought-after goal. So, why is achieving it not as straightforward as we would like it to be?

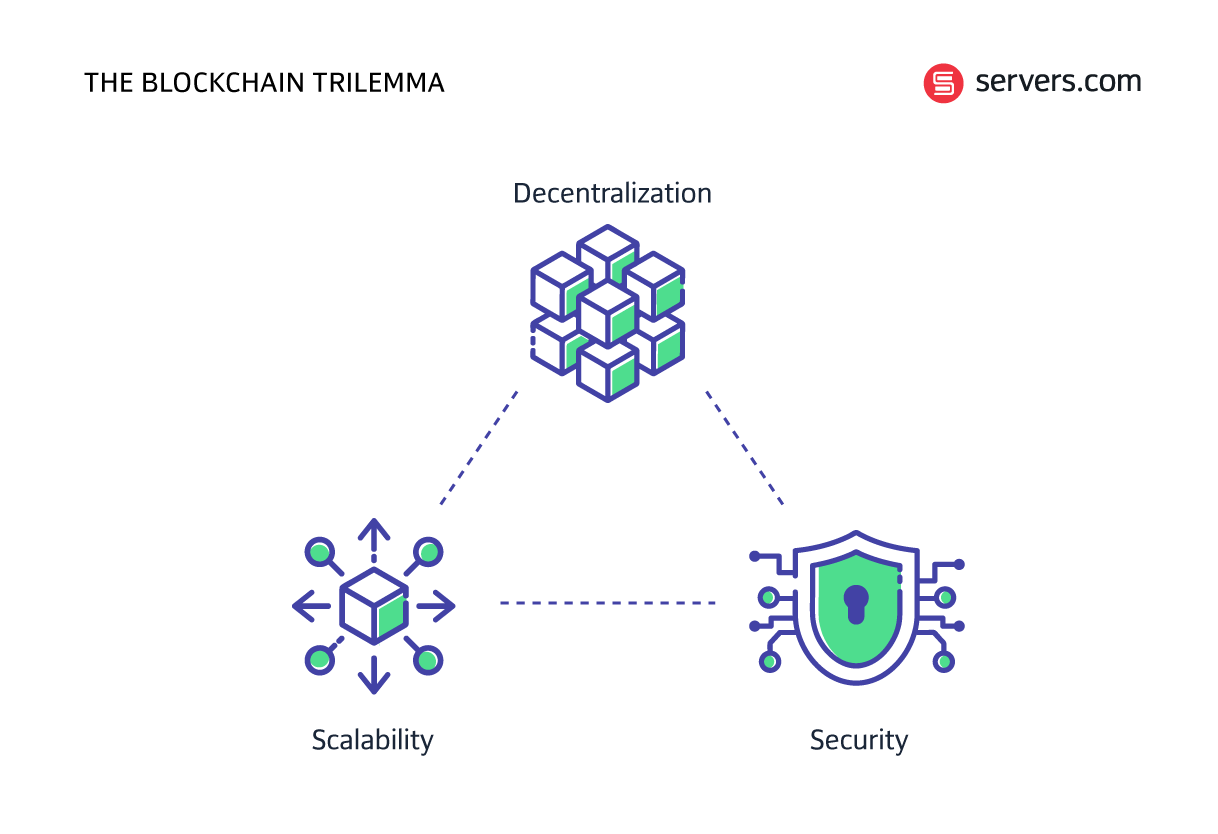

I’d love to claim this snappy title as mine, but it belongs to Ethereum co-founder Vitalik Buterin. It refers to the accepted belief that for blockchain technology to truly work, blockchains need to achieve optimal levels of three important elements: security, scalability and decentralization.

Achieving this balanced split between the three, however, is proving difficult.

Because of its vital role in the ethos of blockchain and crypto, decentralization generally gets prioritized, as does security. Without it, bad actors could attack the chain and it would become void. Which means that scalability tends to suffer and therefore the performance of the blockchain does too.

In a blog on the subject, Binance suggests that “the most obvious and basic solution to the problem…is to reduce the number of participants confirming and adding to the network data in exchange for greater scale and speed. But doing so would lead to a weakening of decentralization with control handed to a smaller number of participants. And it would also lead to a weakening of security as fewer players means a higher chance of attacks.”

It’s a constant trade off and depending on what you’re trying to achieve, you will likely end up focusing on a particular two elements.

One of the advantages of blockchain technology is its versatility. For every project in development there's a different use-case and a different unique selling proposition (USP). For example, some chains might sacrifice decentralization and create a protocol that focuses on security and speed, which would be well suited to traditional financial institutions. Whereas a protocol that focuses on staying as decentralized as possible would have great potential for building privacy focused messaging applications.

It may be that one day someone will solve the trilemma, and then we'll have the perfect blockchain. But until then a huge variety of projects remain out there designed for every possible need.

It's important to remember that this trade-off doesn't mean that a fast blockchain is necessarily less secure than a slower one, or more centralized than an even faster one. The technology is improving every day and developers have managed to greatly improve on each of the three points of the trilemma.

If decentralization is one of the three that you do choose to focus on, there are some important things to look out for. Not all who claim to be decentralized are, for a few very basic reasons.

There are three main mistakes cryptocurrencies and blockchains make when looking to decentralize:

Node monopoly. Take Ethereum for example. On paper, it’s highly decentralized because it has nodes run by thousands of different people. But when Ethereum approves people to run their nodes within the Ethereum system, it gives them a selection of node providers to choose from, including the big three cloud hyperscalers. Guess how many people choose AWS?

In fact, AWS owns more than 50% of the network. So, what is promoted as an example of decentralization is actually highly centralized.

Centralized locations. You might have done your due diligence and made sure that you’re working with say three different infrastructure hosting providers for your blockchain. What you may not have looked in detail at is where those providers’ infrastructure actually sits.

Hosting companies don’t all have their own data centers and will often share data center space with competitors. The problem is that when that data center goes down, your carefully curated ecosystem of node providers that all happen to be in the same data center all suddenly go down together.

The same third-party. A similar point to the above - when you are sourcing node hosting providers, are they selling you their hardware or someone else's? The reason this is important is that you could be buying all of your hardware from one central provider without realizing it.

The world of crypto is not as decentralized as we believe it to be, or the Web3 industry would like it to be. However, even some decentralization can be hugely impactful.

And because the industry is an innovative one, there are already ideas circling to help achieve optimal levels of the blockchain trilemma, such as Layer-2 solutions, consensus mechanisms through Proof of Stake and sharding. But that’s a blog on its own.

With just a few simple due diligence measures that can be carried out with node hosting providers, crypto exchanges and the blockchains they rely on can work towards avoiding unintended centralization and a fairer finance system.

As Vitalik Buterin, Founder of Ethereum said, “if crypto succeeds, it's not because it empowers better people. It's because it empowers better institutions."

For more information about our dedicated hosting solutions for Web3, speak to a member of our team.

Last Updated: 12 October 2023

Our resident Web3 expert, James helps customers that are busy changing the world by disrupting traditional frameworks to realize a decentralized future. Watch out, he practices Brazilian Jiu Jitsu.