Table of contents

In modern electronic trading, the competitive landscape is defined by speed, consistency, and access. Your choice of data center locations defines all three. Where your trading infrastructure physically lives directly influences execution quality, access to liquidity providers and exchanges, operational resilience, and compliance.

Because of this, location must be a critical component of every trading platform’s infrastructure strategy. Below, we explore why global data center locations matter for trading, which hubs shape today’s markets, and how infrastructure choices determine your ability to deploy trading systems where they perform best.

Trading performance, platform redundancy and compliance are directly tied to where your trading infrastructure is located. Having infrastructure in the right locations is key to reducing latency and serving global markets - and it’s also the foundation for resilience and compliance.

In high-frequency trading, microseconds equate to money. Trade execution, slippage, profit and loss (P&L) are all impacted by how long it takes an order to reach the exchange’s matching engine and return a fill.

For this reason, trading servers need to be physically located as close as possible to the exchanges they interact with. Even small reductions in distance can meaningfully reduce round-trip times.

It’s why major exchanges offer colocation, and why third-party data centers tend to cluster around them. Locations like Equinix’s London campus have grown into global finance infrastructure hubs for this very reason.

As well as being faster, shorter paths also offer predictability. Fewer intermediary hops, reduced packet loss, and more consistent order-routing all contribute to stable performance and a reduction in variance.

It’s precisely how FxGrow optimized the performance of their Forex brokerage platform. In partnership with servers.com, FxGrow was able to host their trading infrastructure close to their bridge infrastructure based out of Equinix London and achieve ultra-low latency.

Mohammad Mazeh, Head of Brokerage and Platform Administration at FxGrow explains: “Minimizing the latency from our trading infrastructure to the bridge infrastructure is a huge selling point. When we get closer to our bridge provider, we minimize the latency from trading execution to liquidity providers (LPs) and pricing aggregation from LPs. This minimizes errors and latency with our traders.”

Today’s financial markets are highly fragmented. Liquidity is spread across dozens of venues from electronic communication networks (ECNs) and regional exchanges to dark pools and asset-class-specific platforms.

For example, US equities are primarily based in New York and New Jersey whereas US futures and derivatives center around Chicago. European equity hubs include London, Frankfurt and Amsterdam, whilst Forex hubs span continents from London to New York to Tokyo.

It means securing high frequency trading infrastructure across multiple strategic locations is essential for maintaining low latency access. A distributed footprint of global data centers for trading is fundamental to supporting cross-market arbitrage, multi-asset trading, and real-time global liquidity access. Without hardware in the right locations, firms rely on long-distance connectivity, which becomes a significant disadvantage to execution.

Whilst not exhaustive, the table below provides an overview of today’s most critical trading data center regions and their respective strategic value. Each location plays a unique role, and the most competitive trading platforms will choose to have infrastructure located close to several of these hubs.

| Location | Strategic value |

|---|---|

| New York | Heart of US equities with proximity to key exchanges including New York Stock Exchange (NYSE), Nasdaq Stock Exchange (NASDAQ), BATS Global Markets (BATS), and the Investors Exchange (IEX). |

| Chicago | Global center for futures, options and derivatives and home to CME Group matching engines. |

| Washington | Often used as a regional backup or secondary location for US workloads. |

| London | Europe’s largest financial hub. Critical for FX, multi-asset trading, prime brokerage and access to EU Liquidity. |

| Frankfurt | Core gateway to continental European markets, settlement systems, and Eurex derivatives. Can be used as a backup location for European trading. |

| Amsterdam | Often used as a regional backup for European trading. |

| Hong Kong | Key hub for Honk Kong equities, APAC derivatives and Chinese market connectivity. |

| Singapore | Growing APAC powerhouse for multi-asset trading, arbitrage, and global operations. |

| Tokyo | Gateway to Japanese equities (TSE) and major APAC FX liquidity providers. |

In addition to millisecond-to-millisecond performance, where your hardware is physically located also impacts operational resilience. Trading platforms face several external risks. Everything from natural disasters or power grid failures to regional political mandates and changes to regulation.

Having a geographically diverse data center footprint is key to ensuring resilience against these uncertainties. It means if a primary site fails, systems can failover seamlessly to a secondary site - ideally one close enough to preserve acceptable latency to key liquidity providers.

For example, you might have a primary site in London and a secondary site in New York for FX trading. Or a primary site in Chicago and a secondary site in New Jersey for futures and equity derivatives.

Without geographically distributed data centers, risk is concentrated in a single region so planning disaster recovery into your infrastructure architecture is essential.

Common disaster recovery architectures include:

When ArkTechnologies partnered with servers.com, the trading platform needed to ensure they could maintain low latency and network stability no matter what. Supported by our fintech specialist, Mike, the team were able to introduce an extra layer of redundancy into their stack. Co-Founder and CTO, Iyad Yasser explains:

“On Mike's suggestion, we implemented a proxy server (an intermediary server stored in a different data center that sits between the customer and server providing their resource) as a redundancy measure. This way, if our main server in Amsterdam is affected by ISP maintenance, the client can connect to a server in Hong Kong via servers.com's global private network, ensuring lower latency and network stability.”

Trading is one of the most heavily regulated industries in the world, and where your infrastructure is located directly shapes your obligations. Trading platforms may need to observe regional data residency laws, adhere to cross-border data transfer rules, or comply with exchange-specific requirements.

For regulated financial data (especially client data), multi-region infrastructure setups are key to balancing compliance requirements. For example, an EU-based trading platform might need to process regulated EU customer data in an EU based data center but may choose to process unregulated anonymized datasets in the US or APAC where it’s typically cheaper to do so.

Similarly, a trading platform might be subject to exchange-specific requirements mandating that front-office trading systems be deployed near a specific exchange. At the same time, they might also fall under laws that require them to store sensitive information in a different, jurisdiction-appropriate, location.

Choosing the right locations is only half the battle. Trading platforms also need infrastructure partners that can place them there, and this is where hyperscale cloud solutions often fall short. Hyperscale cloud solutions are built for elastic, general-purpose workloads not exchange-adjacent trading.

Because of this, these providers typically base their data center operations around broad regional clusters which are often too far from financial hubs to be viable for trading workloads. Even if you choose the cloud region closest to your required exchange, it may be tens (or hundreds) of kilometres from the matching engine.

For example, AWS eu-west-2 serves London but is several kilometers away from the primary trading hub in Equinix LD4/5. Similarly, AWS us-east-1 in Virginia is hundreds of kilometers away from critical exchanges in New York. For trading workloads, that extra distance is enough to slow down execution and cause trade slippage.

For high frequency trading infrastructure, bare metal solutions offer high-performance dedicated servers in locations strategically placed near financial hubs. That could mean in a colocation facility within the same building as the exchange, or in a bare metal cloud provider’s data center within microseconds of it.

There’s no doubt that distance from exchanges matters when choosing high-frequency trading infrastructure. But it needs to come with a major caveat. Because while a few kilometers are enough to slow execution and cause slippage, a few meters aren’t.

The intense competition for rack space in Equinix’s LD4 data center is a prime example of a trading trend turned misconception.

Equinix LD4 is prized as the original, critical global financial hub and internet exchange point serving London. The facility was originally built in 2007 by IX Europe but was acquired by Equinix just before its initial opening when it became known as LD4. As one of the first data centers built around London, liquidity providers and banks quickly clustered around it for its strategic location and low-latency routes to central London exchanges.

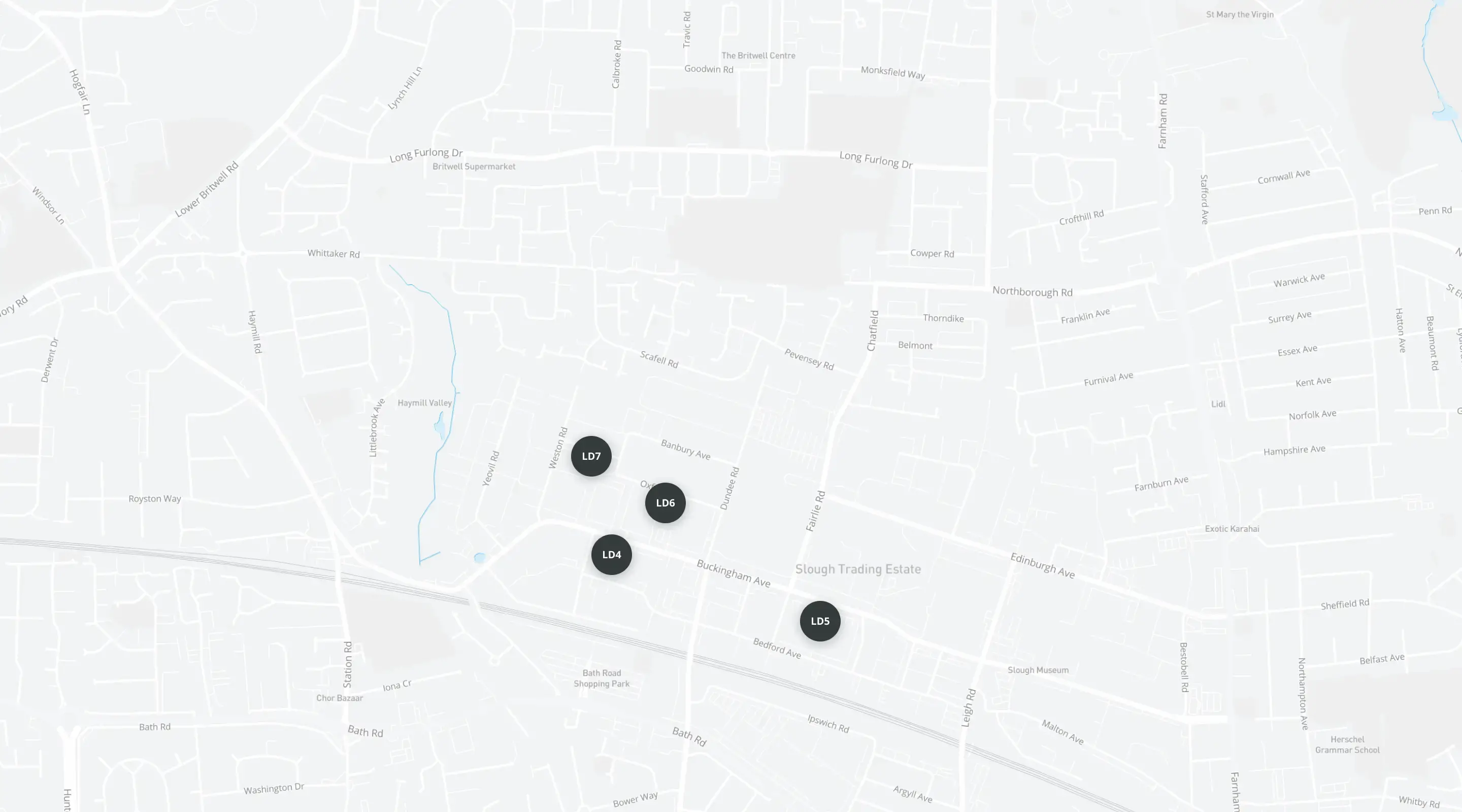

As a result, Equinix has actively managed the growing demand for space here through expansions of its Slough-based campus, starting with the Equinix LD5 data center and later followed by LD6, LD7 and LD10.

All these buildings sit within the same campus in a tight cluster and benefit from fiber cross-connects between them. In fact, LD6 is so close to LD4, that you could practically reach over from one and touch the other. Latency differences between them are negligible. Yet competition for, and status derived from, a presence in LD4 remains huge.

The same can be said for Equinix’s Secaucus hub which houses NY2, NY4, NY5 and NY6 - similarly closely interconnected with minimal latency variance. Ultimately, what really matters is being in the correct hub. Once inside the right cluster, performance is effectively identical across facilities, and connectivity ecosystems are well-optimized.

Choosing the right city or the right exchange proximity is far more impactful than choosing between two buildings within the same financial zone.

Access to the right locations is key to market confidence and success in trading. Firms that deploy infrastructure across global financial hubs gain a strong competitive advantage in the form of lower latency, access to fragmented markets, stronger disaster-recovery and compliance readiness. And it’s why choosing infrastructure partners that can get you in the best global data centres for trading is so important.

Expanding into new geographies? Speak to our fintech specialists about deploying bare metal cloud as part of your proximity hosting strategy.

Low-latency, high-frequency trading refers to automated trading that relies on microsecond-speed data processing and order execution. The closer your high frequency trading infrastructure sits to an exchange’s matching engine, the lower the latency and the better your fill quality and trade slippage control.

Data center connectivity affects how quickly orders reach exchanges and liquidity providers. Shorter physical distance, fewer network hops, and access to major financial hubs reduces trade slippage and improves execution speed.

High-frequency trading infrastructure should be underpinned by high-performance dedicated servers placed near key financial hubs. Colocation or proximity bare metal cloud hosting is essential because general hyperscale cloud regions generally sit too far from matching engines.

Start by moving your trading infrastructure closer to the exchange to reduce physical distance, or establish a cross-connection. Evaluate bare metal or colocation options that provide access to global data centers for trading with points of presence physically located within major financial hubs. This way you’ll be able to optimize network routes and establish a multi-region setup that improves speed, reliability and resilience.

It depends. Distances of a just a few meters are negligible. For example, if you already have a fast connection in Equinix LD6 or LD7, moving your hardware a couple of meters closer to the exchange in LD4 is unlikely to bring tangible performance improvements. More significant distances of a few kilometres are what matter. These can have a real impact on trading speed. As a rule, making sure you’re in the data center campus, closest to the exchange is a good idea - but you don’t need to worry about the specific building.

Frances is proficient in taking complex information and turning it into engaging, digestible content that readers can enjoy. Whether it's a detailed report or a point-of-view piece, she loves using language to inform, entertain and provide value to readers.